Cecilia Lynch

Chief Strategist

Cecilia has a special gift for strategic thinking. Cecilia is extremely professional, gets involved in the organization, and is always fun to work with. People enjoy working with her because she brings energy and fun to her work. After working with her, anyone else would have a high bar to meet.

Great strategic framework! Cecilia has the best strategic mind I have ever worked with.

Cecilia does a terrific job moving us through the planning process and making us address the more difficult issues. The strategic planning session was very effective in getting agreement on a new mission statement, a framework for evaluating opportunities and making go/no go decisions about those opportunities, and initiatives for programs and development.

Cecilia is a master strategic thinker, but I was surprised and delighted to learn a number of really valuable tips to make my consulting practice more successful.

WHO IS CECILIA?

Meet Cecilia, the founder and Chief Strategist of Focused Momentum LLC.

In this short video, Cecilia shares the story of how her unique approach to planning propelled her career and launched her strategic planning firm.

Chief Strategist

Hire Cecilia as your Chief Strategist and ensure the success of your next strategic planning effort.

Shadow Consulting

Elevate Your Strategic Planning with the Expert Guidance You Need

.png)

Learning Opportunities

Learn Cecilia's tool, techniques, methods and consulting practices to use on your next project.

Intrigued by Cecilia's story?

Learn more about how she thinks by reading some of what she has authored.

Get a sense of the strategist's mind by scrolling through Cecilia's recent blog posts. Find a post that speaks to a challenge you are facing and share it with others to propel your planning and management.

“We know a lack of clarity means decision-making is challenged. Indecision feeds frustration and fosters misalignment among the ranks working in the business or nonprofit. Ultimately distracting folks and reducing their productivity.”

Download one or all of Cecilia's eBooks. Each eBook is focused on a unique topic those responsible for strategic planning or in a strategic management leadership role face today.

“When I see recurring themes in our work, I am compelled to write about them. My eBooks are designed to provide meaningful insights that can be quickly applied to address challenges today's leaders face.”

Get a sense of what it's like to have access to this level of strategic planning expertise. Take a few minutes to view one of Cecilia's free tutorial videos.

“Strategic Planning is not an activity most leaders engage in regularly - it's not their strongest muscle. That's where we come in. We leverage our client's knowledge and experience with our strategic planning expertise.”

Strategy Class is Focused Momentum's training platform. It is designed to provide access to the strategic thinking, planning, and management tools developed in over 20+ years of strategy consulting engagements. It is for entrepreneurs, company leaders, students, and consultants. All programs are developed by Cecilia, and live sessions are led by her.

“Not everyone needs or can afford to hire a strategy consultant. With Strategy Class, we can make strategy possible for everyone!”

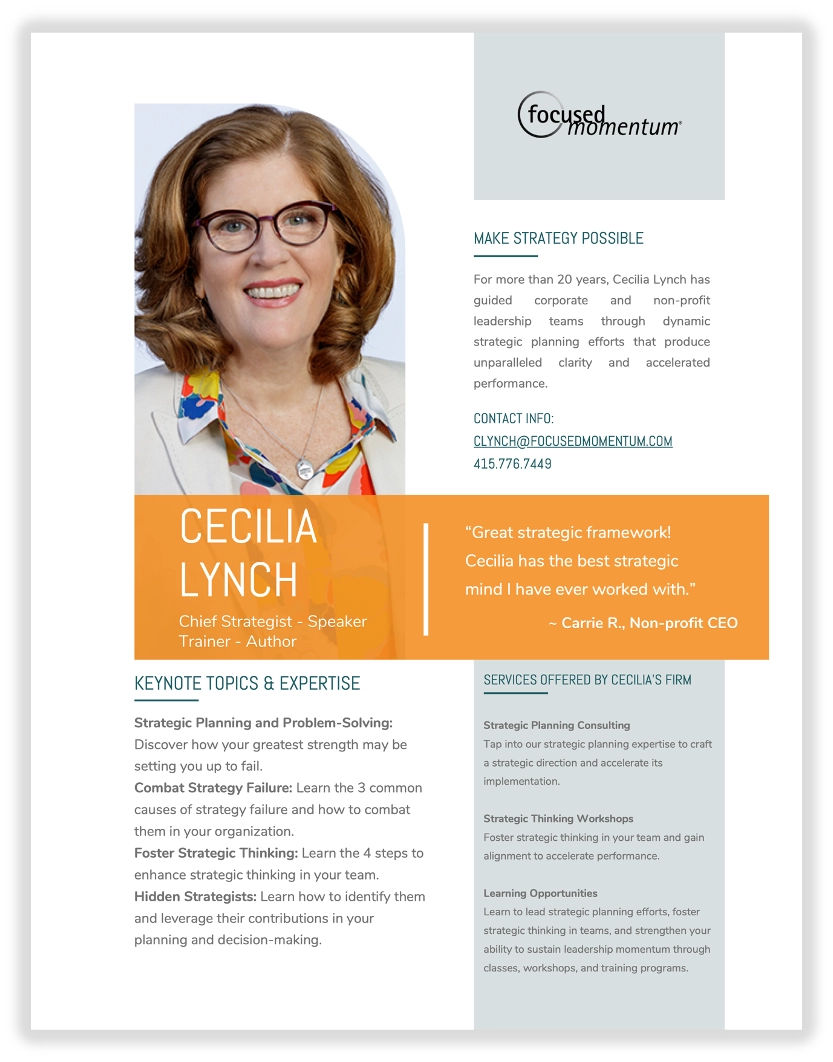

For more than 20 years, Cecilia Lynch has guided corporate and non-profit leadership teams through dynamic strategic planning efforts that produce unparalleled clarity and accelerated performance.

Hire Cecilia to speak at your next event.

Topics include:

Strategic Planning and Problem-Solving

Discover how your greatest strength may be setting you up to fail.

Combat Strategy Failure

Learn the 3 common causes of strategy failure and how to combat them in your organization.

Foster Strategic Thinking

Learn the 4 steps to enhance strategic thinking in your team.

Hidden Strategists

Learn how to identify the hidden strategist in your organization and leverage their contributions in your planning and decision-making.

ONE-PAGE SPEAKER INFORMATION SHEET

Learn more about Cecilia and what value she brings to your event.

download digital version

WANT TO LEARN MORE?

Send us a quick note and we can set up a call to discuss how we might help you MAKE STRATEGY POSSIBLE in your organization.